5 Easy Facts About Do I Have To List All My Debts When Filing Bankruptcy in Virginia Described

If you don’t list a creditor within an asset case, that creditor unfairly loses out on its share of money. So, the rule is that the debt owed to an unlisted creditor within an asset circumstance is nondischargeable.

Sure, nevertheless the collector will have to first sue you to secure a court docket get — named a garnishment — that claims it might take income from your paycheck to pay for your debts.

A collector also can receive a court get to consider revenue from a banking account. Don’t disregard a lawsuit, or you may eliminate the chance to battle a court order.

Chapter thirteen is sometimes termed the Wage Earner’s Bankruptcy, and permanently rationale. Chapter thirteen is bankruptcy for people who find themselves earning cash but have fallen desperately powering trying to keep up with payments for things acquired on credit score.

The complex storage or obtain is needed for the genuine intent of storing Choices that aren't requested through the subscriber or person.

No-asset circumstance. Should you unintentionally forget about to list a creditor inside a no-asset situation—a case in which there’s no money to distribute—the result could go In any case. Courts typically have a “no damage, no foul” technique as the unlisted creditor wouldn’t have gotten nearly anything anyway, Although not normally.

A Chapter 13 prepare lasts for a presumptive duration of five years, Except if all debts have been compensated off in a lot less time. You and your attorney will choose with each other the time period which very best meets your preferences.

Why would you want to quit your precious residence and belongings? Liquidation check my site in Chapter 7 bankruptcy is supposed that will help blog absolutely free you from your gathered debt which that you are struggling to pay back.

Beneath Chapter 13, the court has the power to shield the debtor from the actions of creditors. A private debt consolidation services does not. The court docket has the power to ban creditors from garnishing wages, foreclosing about the debtor’s house and from repossessing the debtor’s car. The courtroom also has the ability to force certain creditors to accept a you can look here Chapter 13 plan that pays only a part of the claim.

Cara O'Neill is actually a legal editor at Nolo, focusing on bankruptcy and compact promises. She also maintains a bankruptcy observe in the Law Business office of Cara O’Neill and teaches prison regulation and authorized ethics as an adjunct professor.

You will commonly have to have to provide copies of your respective tax returns or tax transcripts for the last two many years inside of a Chapter seven situation and 4 yrs within a try here Chapter thirteen make a difference.

You should NOT even so test to pay back again money owed to members of the family before the filing of your bankruptcy circumstance!

You may assume creditors to simply call until eventually you file. It's usually finest to disregard them mainly because telling creditors regarding your bankruptcy can motivate them to acquire much more drastic assortment ways ahead of dropping the right to gather entirely. Nevertheless, in right here case you retain the services of counsel and refer creditors on your attorney, they're going to have to prevent calling you.

Chapter thirteen also has significantly less of the blow since – if you full your repayment strategy – you may at the least have recognized a track record of paying your charges.

Ralph Macchio Then & Now!

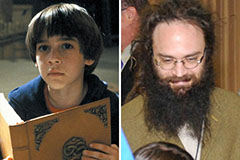

Ralph Macchio Then & Now! Barret Oliver Then & Now!

Barret Oliver Then & Now! Kelly Le Brock Then & Now!

Kelly Le Brock Then & Now! Traci Lords Then & Now!

Traci Lords Then & Now! Brooke Shields Then & Now!

Brooke Shields Then & Now!